Euler Hermes, the worldwide leader in trade credit insurance presents its latest analysis on the global economy and the related impact on South Africa’s export performance. The global economy is expected to prove its resilience in 2016 registering +2.4% growth, after a year of turbulences. It should pick up moderately to +2.8% in 2017, driven up by the U.S. post-election uncertainty, and emerging markets. However, as a consequence of the still modest global growth outlook, business insolvencies are expected to accelerate by +2% in 2017, after +1% in 2016, the first increase since the global financial crisis. Insolvencies will continue to rise in most emerging markets and in the U.S. and to decrease in Europe.

“The global economy was hit by several shocks over the past quarters, said Ludovic Subran, Euler Hermes Chief Economist. These shocks offset the positive effects that lower prices should have had on growth. Bumpy growth is here to stay in 2016 registering the weakest growth rate since the great recession. In 2017, growth will remain fragile and below +3% for the sixth year in a row”.

South Africa: coping, one shock at a time

Three external headwinds have hampered growth prospects in South Africa this year (i) weak international commodity prices, with commodities accounting for 14% of total GDP; (ii) a slowdown in China, the country’s largest trade partner; (iii) and the uncertainties surrounding the U.S. monetary policy tightening. If one adds the drought conditions, with weakened agricultural output and import of maize and other foodstuffs, GDP growth is expected at only +0.5% in 2016. As external and domestic conditions normalize, growth should pick up again in 2017 around +1.5%. This will continue to be subpar as business confidence indicators are still low and turbulence is on. For instance, bankruptcies are expected to increase by +5% y/y in 2016 and again in 2017, which will be the first outright deterioration since the 2009 global financial crisis.

“Despite the improvements in the external environment, South Africa will be vulnerable to capital flow and exchange rate volatility, as the economy is still unbalanced and the twin deficits persist,” stated Ludovic Subran. “There will be a modest recovery next year as the commodity and drought shocks dissipate but corporate investment is the big question mark.”

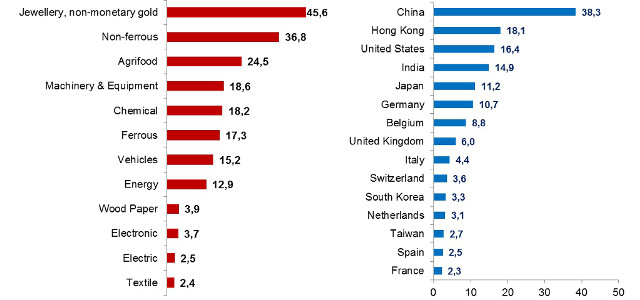

Exports will be one of the key drivers to rebound. Euler Hermes expects an additional ZAR +201bn in goods exports in 2017, as world trade will grow by +5.7% in value terms, next year, compared with -2.9% in 2016. China (along with other Asian economies) and the U.S. will be the main destinations. It shows that South Africa can benefit from a slight uptick in global trade for its wealth (gold, ferrous, and non-ferrous) and its companies. Commodities, agrifood, machinery and equipment and the automotive sector will lead the export battalion as the widespread export culture among the private sector and the strategic position at a crossroads of continents will be top strengths.